CFP, FCMA, MA, LL.B, M.Com.

Company Name: | SKYWEALTH FINSERV PRIVATE LIMITED | ||

Nature of business: | Financial Advising & Financial Planning, Scientific Money Management, Day-to-Day Money Management Mantras, Financial Freedom & Financial Transformation |

"Creating Awesome Lives"

Skywealth Finserv Pvt Ltd., a companion on your life’s journey to realise your dreams. We exist to make a difference in your life and to make you live your desired life. Managing money is more important than making money and this is where we come in. How do you manage your money effectively? is the most common problem that people face, and we have the expertise to guide, assist, and solve your money management problems.

CFP. FCMA. Rajendra Reddy Kandula is an individual who has excelled in the fields of finance, law, and entrepreneurship, He is highly accomplished professional with a remarkable portfolio of qualifications and achievements.

As a Certified Financial Planner and Cost

Accountant, Mr. Rajendra brings a wealth of expertise in financial planning,

investment analysis and cost management. Their rigorous training, coupled with

practical experience, has earned them the prestigious designations of a

Certified Financial Planner, USA and a Cost Accountant with Fellow Membership,

underscoring their commitment to excellence in the realm of personal and

business finance.

In addition to their financial prowess, Mr. Rajendra has also pursued higher education, holding degrees in LL.B, MA, and M. Com, he also completed many more certificate courses and Diploma Courses in the matter of Finance, like Alternate Investment Manager, Chartered Debt Advisor, SEBI Registered Investment Adviser etc., This diverse educational background equips them with a comprehensive understanding of legal principles, economic theories, and financial strategies, enabling them to offer holistic advice to their clients.

Our Mission

Our mission is to transform the lives of 10,00,000 families by educating them about financial literacy and empowering them to live a financially stress-free and confident life though our scientific money management process.

Our Vision

Our vision is to become the most admired & recommended investments & financial service provider in the industry.

Our Belief

The secret to success in business is to serve clients. Put clients first in all you do.

More details visit our website at

Pooled Investments made in venture capital, private equity, hedge funds, managed futures etc. are called alternative investments. In other words, an investment not made in conventional investment avenues such as stocks, bonds, real estate etc. may be considered as alternative investments.

As

per SEBI, AIFs are classified in three broad categories. Category I & II

AIF are close ended & the tenure of the scheme is a minimum of three years.

Whereas Category III AIF can be open-ended or close ended

Category I AIF

Mainly invests in start- ups, SME's, social ventures, venture capital, infrastructure, or any other sector which Govt. considers economically and socially viable for the Indian economy. e.g., Venture Capital Fund, Infrastructure Fund, Social Venture Fund, Angel Fund

Category

II AIF

These include Alternative Investment Funds such as private equity funds or debt funds which invest in equities and/or debt securities and which are not provided by any specific incentives or concessions by the government or any other Regulator.

Category

III AIF

Funds that engage in a variety of complex trading techniques, such as investing in listed or unlisted derivatives, fall into Category III. Hedge funds are typically included in this category. These are normally Open-ended funds e.g., Hedge Fund, Private Investment in Public Equities (PIPE) Fund

More details visit our website at

http://skywealthfinserv.com/Home/Index

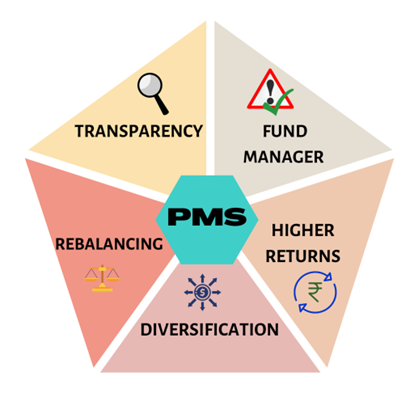

Portfolio Management Services (PMS) is a specialized investment service offered by financial institutions and wealth management companies to manage the investment portfolios of individual and institutional clients. PMS aims to create and manage a diversified portfolio of securities (stocks, bonds, mutual funds, etc.) tailored to the client's financial goals and risk tolerance.

Types of PMS: PMS can be categorized into two main types.

· Discretionary

PMS: In this type, the portfolio manager has full discretion to make investment

decisions without requiring client’s approval for each transaction.

· Non-Discretionary PMS: In this type, the portfolio manager provides investment advice and recommendations to the client, but the client retains the final authority to approve or disapprove investment decisions.

More details visit our website at

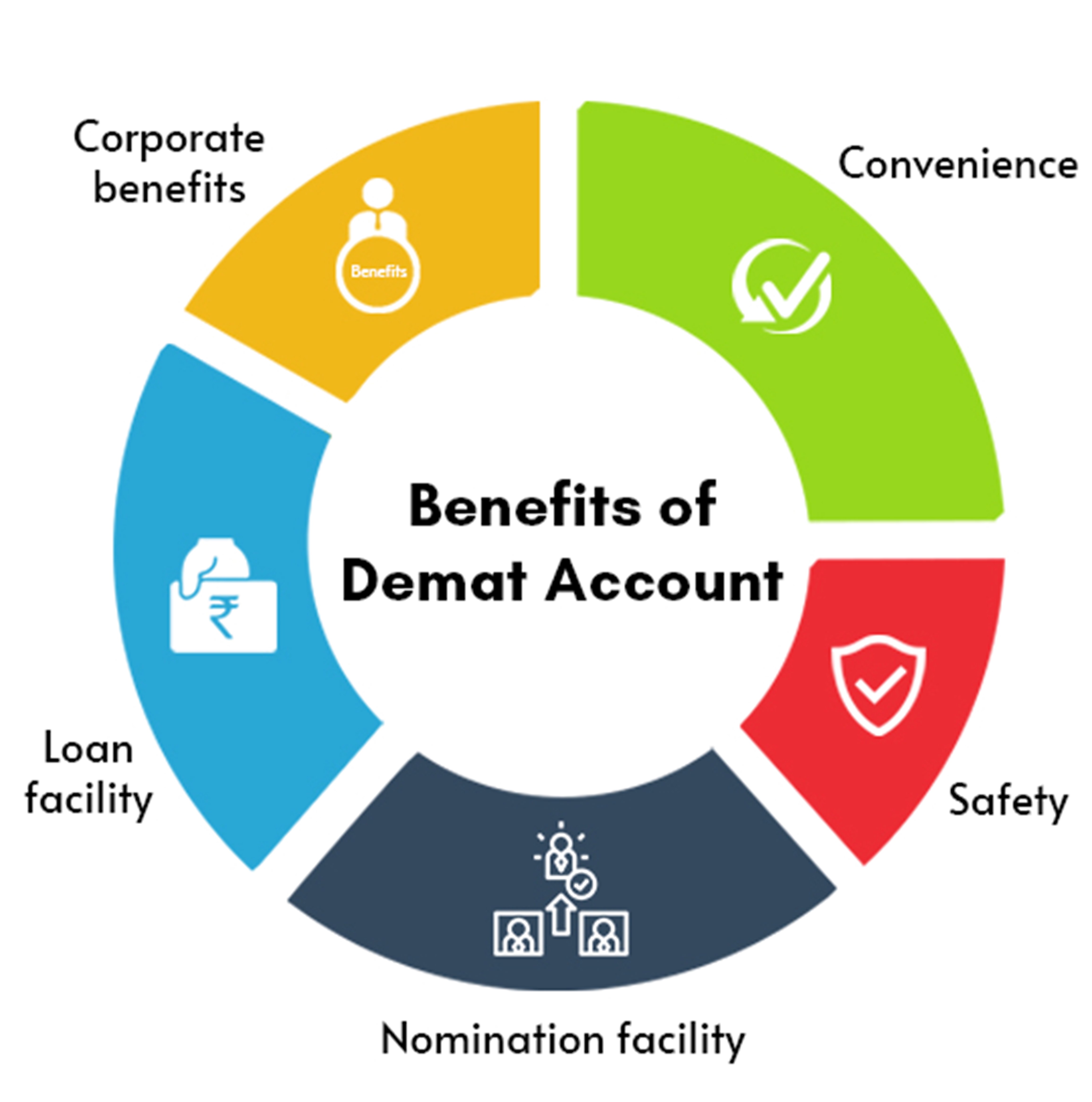

A Demat Account contains the details of the shares and other securities in your name.to purchase and sell shares, you need to open A trading account, many bank accounts and brokers offer trading accounts with online trading facilities, which makes it easier for ordinary investors to participate in the stock market.

Click Here for Accounting

Opening

https://secure.icicidirect.com/customer/accountopening?rmcode=RAJH6920

More details visit our website at

Financial Wellness Program

Financial

Wellness Program is a 1-2 hour educational and interactive program by personal

finance experts organized in companies, housing societies and associations to

educate the participants about money management principles, growth mindset to

live financially stress-free life.

This

program is designed in such a way that anybody can achieve financial freedom if

he/she is committed.

Key Learnings From The Financial Wellness Program (FWP)

More details visit our website at

http://skywealthfinserv.com/Home/Index

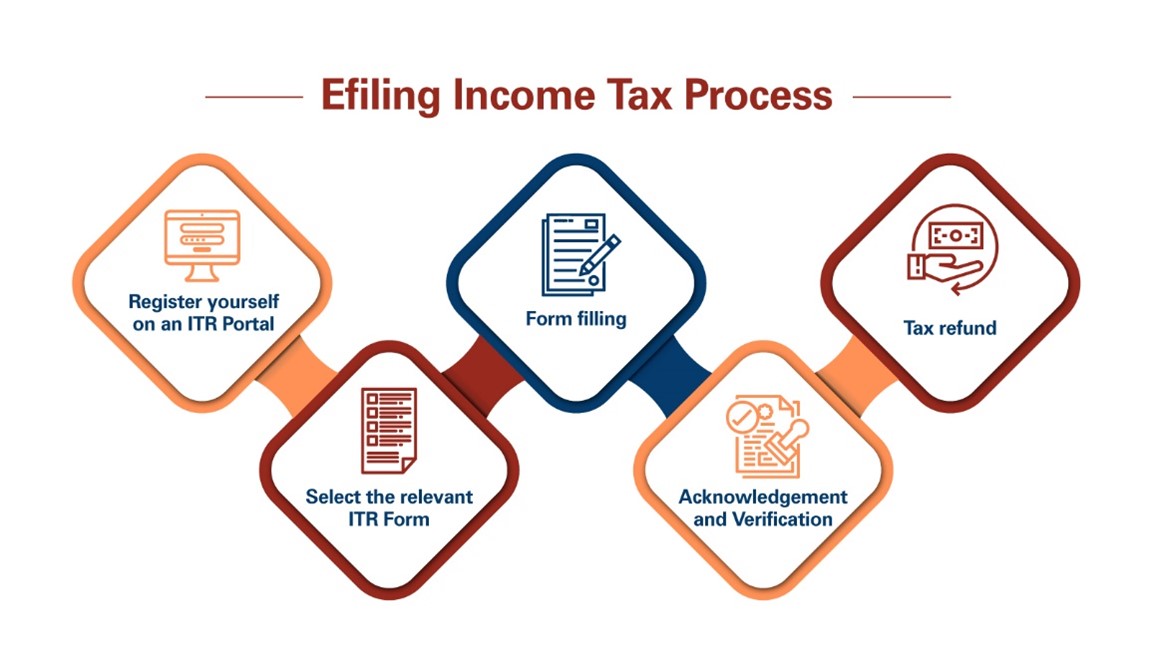

Tax Returns

At Sky wealth Finserv Pvt Ltd, we specialize in providing expert Tax Returns services to individuals and businesses. Our dedicated team of certified tax professionals ensures accurate and timely tax filing, helping you optimize your financial position and comply with tax regulations

Our

services include:

Individual Tax Returns: Streamlined and precise tax filing for individuals, maximizing refunds and minimizing liabilities Business Tax Returns: Comprehensive tax solutions for businesses, including sole proprietors, partnerships, corporations, and LLCs.

With Skywealth, you can trust in our expertise and commitment to deliver accurate, efficient, and personalized Tax Returns services. Contact us today to ensure your tax compliance and financial peace of mind.

More details visit our website at

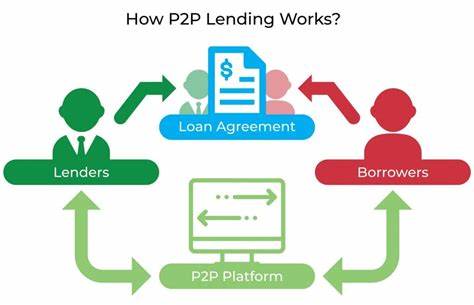

Peer-to-peer lending is an online financial framework that connects lenders/investors and borrowers on an online platform without a bank acting as a third party.

This lack of intermediaries, and subsequently the lower costs involved,

make P2P lending an attractive investment opportunity.

It is regulated by RBI. You can invest as a lender and get attractive

interest rates, usually more than traditional investments on your deposits.

More details visit our website at

A Loan

Against Securities (LAS) is a financial product that allows individuals or

businesses to obtain a loan by pledging their investment securities as

collateral. This type of loan is provided by banks, financial institutions, or

brokerage firms,you can leverage your investments to access quick, hassle-free

funds for both personal financial needs or business expansion.

Here's how a Loan Against Securities typically works.

1. Collateral

2. Loan Amount

3. Interest Rate

4. Loan Tenure

5. Repayment

6. Liquidity and Investment Continuation

7. Risk of Margin Calls

8. Loan Purpose

9. Tax Considerations

10. Loan Closing

Loan Against Securities can be a convenient source of funding for individuals and businesses who have a portfolio of marketable securities but prefer not to liquidate their investments. However, it's essential to carefully consider the terms and conditions, including interest rates, LTV ratios, and potential risks associated with such loans before entering into an agreement. Additionally, borrowers should have a clear repayment plan to avoid any adverse consequences, such as a margin call or the forced sale of their securities.

More details visit our website at

Corporate Fixed Deposits, often referred to as Corporate FDs, are investment instruments offered by corporations and non-banking financial companies (NBFCs) to raise funds from investors. They are similar in structure to traditional bank fixed deposits (FDs), but they are not offered by banks. Corporate FDs are considered a type of fixed-income investment.

Corporate Fixed Deposits, often referred to as Corporate FDs, are investment instruments offered by corporations and non-banking financial companies (NBFCs) to raise funds from investors. They are similar in structure to traditional bank fixed deposits (FDs), but they are not offered by banks. Corporate FDs are considered a type of fixed-income investment.

Corporate Fixed Deposits can be an attractive investment option for individuals seeking higher returns than those offered by traditional bank FDs. However, they also carry higher risk, and We will carefully assess the issuer's financial stability and credit rating. Diversifying investments across multiple issuers can help reduce risk.

With Skywealth, you can make informed investment decisions, secure attractive returns, and achieve your financial objectives through Corporate Fixed Deposits.

More details visit our website at

Capital gain bonds, also known as capital gains tax exemption bonds, are financial instruments issued by government agencies or financial institutions. These bonds are primarily used by individuals or businesses to defer or exempt taxes on capital gains arising from the sale of certain assets, typically real estate or property. Here are key points about capital gain bonds:

· Eligibility

and Use: The eligibility criteria, maximum investment limits, and types of

assets eligible for capital gain tax exemption may vary from one country to

another. In many countries, these bonds are used to defer capital gains tax

when selling real estate, especially agricultural land or residential property.

· Issuers:

Capital gain bonds are typically issued by government agencies or financial

institutions authorized by the government. In India, for example, the Rural

Electrification Corporation (REC) and National Highways Authority of India

(NHAI) have issued such bonds.

· Lock-In

Period: Generally, capital gain bonds come with a lock-in period during which

the investor cannot redeem or sell the bonds. This lock-in period is typically

three to five years, but it can vary depending on the specific bond issue.

· Interest

Income: Investors receive periodic interest income from these bonds during the

lock-in period. The interest rates on these bonds are usually fixed and may

vary depending on the issuer and prevailing market conditions.

· Tax Exemption: In many cases,

the interest income earned from capital gain bonds is tax-exempt, providing an

additional tax benefit to investors.

· Capital Gains Tax Deferral: The capital gains tax

is deferred until the maturity of the bonds or their sale, whichever occurs

earlier. At that point, the capital gains tax liability is triggered, and the

investor is required to pay taxes on the capital gains. The investor can also

choose to reinvest in another set of capital gain bonds to continue deferring

taxes.

· No Transferability: Capital gain

bonds are typically non-transferable, meaning they cannot be sold or

transferred to another individual or entity.

· Use of Proceeds: The proceeds

from the sale of the capital asset are required to be invested in the capital

gain bonds within a specific time frame to be eligible for tax benefits.

· Redemption and Maturity: At the

end of the lock-in period or upon maturity, the investor can redeem the bonds

and receive the principal amount along with any accrued interest.

With Skywealth, you can make informed decisions, optimize your tax liabilities, and secure your financial future through Capital Gain Bonds. But the eligibility criteria and rules can be complex and subject to change.

More details visit our website at

Government of India bonds, also known as G-Secs or government securities, are debt instruments issued by the Government of India to raise funds for various purposes, including financing fiscal deficits and undertaking development projects. These bonds are considered one of the safest investment options in India, as they are backed by the full faith and credit of the Indian government.

The Government of India issues several types of bonds, including:

More details visit our website at

Angel

Funds / Venture Capital Funds

Angel

funds, also known as angel investment funds or angel groups, are investment

vehicles that pool money from a group of high-net-worth individuals, often

referred to as "angel investors." These funds are designed to provide

early-stage funding and support to startups and emerging companies. Angel

investors are rich people who invest their own money in companies. Venture

capitalists are employees of risk capital companies who invest other people’s

money in companies.

Angel funds

play a crucial role in the early-stage funding ecosystem, helping startups

bridge the gap between initial seed funding and later-stage venture capital

investments. They provide not only capital but also mentorship, industry

expertise, and valuable connections to entrepreneurs. Entrepreneurs seeking

funding from angel funds typically need a compelling business idea, a

well-thought-out business plan, and a strong pitch to attract these investors.

Venture

Capital (VC) funds are investment vehicles that provide financing to

early-stage and high-growth companies in exchange for equity ownership or

convertible debt. These funds are typically managed by professional venture

capitalists who have expertise in identifying promising startups and helping

them grow.

Venture

capital plays a pivotal role in fostering innovation and entrepreneurship by

providing the financial resources and expertise necessary for startups to grow

and scale. However, it's important to note that venture capital is not suitable

for all types of businesses, and startups seeking VC funding must be prepared

to give up equity and work closely with their investors to achieve their growth

objectives.

More details visit our website at

G-pay: |

9885306603 | |

|

||

PhonePe: |

9885306603 | |

|

||

Bank Name: | HDFC BANK | ||

IFSC Code: | HDFC0009380 | ||

Account Holder Name: | M/S. SKYWEALTH FINSERV PVT LTD | ||

Account Number: | 99999885306603 | ||

Account Type: | Current |